TGE Playbook #3 - How do you choose exchanges and market makers?

Welcome to the third article in the TGE Playbook series:

(T‑N months): Three big questions to ask yourself before TGE

(T‑6 months ~ T‑1 month): How do you build awareness leading up to your TGE?

(T‑1 month ~ TGE Day): How do you choose exchanges and market makers? ← you’re here now

(Post‑TGE): TGE is only the start. How to operate post‑TGE?

One big job before a TGE is figuring out liquidity. Founders usually know what a market maker does, but the terms get messy fast. Lots of conflicts of interest. Lots of noise. Here’s a breakdown from a founder’s angle, so you can cut through the clutter and see how to set up token liquidity the right way.

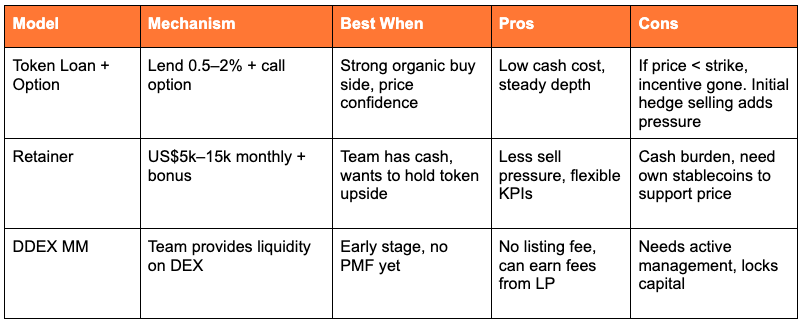

Business models of (passive) market makers

1. Token Loan + Call Option

The project lends the market maker 0.5–2% of total token supply, and gives them call options as compensation. To keep the option worth something, the MM hedges its position (delta-hedge). That naturally creates buy-low, sell-high orders and giving organic liquidity. The MM earns from spreads plus the call option. Because they’ve hedged the option, their P&L is neutral to market direction.

If price crashes to near zero or spikes hard, delta hedging may fail. If market price stays far below strike, the option is nearly worthless and the MM loses incentive. Liquidity dries up.

So this model works best when: the token has steady organic demand post-listing, and price can hold at least near strike. The team also needs strong conviction on valuation and demand.

Best for: confident about listing price and expect strong natural buying demand.

Pros: no monthly fees needed, stable liquidity depth with low cash burn.

Risks: once price slips below strike, the option’s basically worthless and the MM could loses interest. Liquidity can vanish fast. At launch they’ll usually sell a bit to hedge, which adds short-term pressure—so you’ll need real buyers to take it in. But once they reach delta-neutral, the MM can sit on both sides of the book, postin bids and asks and keeping depth stable.

2. Monthly Retainer

The project pays US$5k–15k per month as a retainer, without lending tokens, and may include bonus for certain KPIs.

Best for: teams with enough cash, want to keep tokens in their own hands for flexibility. Can also set custom KPIs to trigger MM bonus.

Pros: MM doesn’t hold large spot position, less risk of dumping your tokens. Fully customizable performance targets.

Risks: Ongoing cash costs can weigh heavily on early projects, and the team also has to put up stablecoins for market making while taking on the downside risk. If the price falls, they’re essentially using their own money to buy back tokens.

I’d rather just pay the retainer fee than waste time arguing with the MM over option value or strike price. It’s cleaner to set KPIs around trading volume, and once that hits a threshold, we’ll hand out a bonus.

— Justin, Co-founder of Zeus (AW Portfolio)

3. DEX Market Making

If your TGE is mainly about fundraising and liquidity isn’t the top consideration, or you just want to save on CEX/MM fees, you can put liquidity straight onto a DEX. Options include classic v2/v3 AMMs, Hyperliquid HIP-2 parameters, Virtuals Genesis Launchpad (lock fundraising assets 1:1), or various products that help projects set up DEX liquidity, such as Teahouse Finance (AW#17).

Best for: the narrative is still early and niche, so it makes more sense to focus resources on building the product while investors are still vesting, meaning deep liquidity isn’t needed yet.

Pros: zero listing or MM fees. With enough volume, project LPs themselves can even earn fees.

Risks: v2 spreads capital too thin and wastes efficiency, v3 uses capital better but needs constant management, and locked pools tie up funds long-term, limiting flexibility when markets shift.

Using HIP-2 is a big help for teams listing on Hyperliquid. It also cuts down the risks MMs face when providing liquidity through the order book

— Ali, Founder of Omo (AW#30)

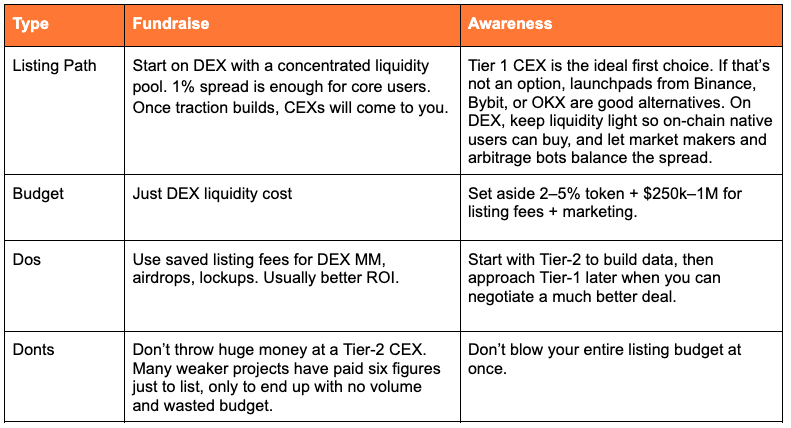

Founders should match model to goals/resources. For fundraise TGEs, DEX MM is usually ideal—cheap and enough liquidity for holders. If the goal is awareness, then choose strategy based on budget and PR goals.

Common mistakes in token market making

MM will help pump my token price? Passive MMs only give depth, not price support. Active pumping isn’t compliant, and both Binance and the FBI have already gone after firms for wash trading. Confidence can disappear fast when exchanges and regulators step in.

Token Loan = MM will dump first? Early sell pressure often comes from delta-hedging, not outright dumping. At launch, MMs may sell borrowed tokens or build short positions to balance the call option’s delta, which creates temporary sell pressure. Some hedge gently using maker orders, while others aggressively use taker orders, which can swing prices more. Once they reach neutral exposure, they usually post on both sides of the book to keep depth. But a few do pump-and-dump—so it’s important to set clear rules, like capping taker order ratios and requiring those ratios to show up in weekly or monthly reports.

Ignoring reporting. Don’t just negotiate token loan terms and strike. You should also ask if the MM will provide daily or weekly reports, dashboards, and data like maker/taker ratios, depth and spread KPIs. MMs willing to share detailed reports are usually more transparent and less likely to have bad intentions.

Liquidity comes from legal binding, not just incentives. Incentives aren’t enough. Contracts need guarantees on spread and depth plus penalties for breaches. Keep in mind that these guarantees come at a cost, but without them you risk attracting bad actors. If founders squeeze MM profits too much by cutting option value or token loan size, the good MMs walk away and the malicious ones take the deal—because they’re not making money from providing liquidity.

Tips for choosing MMs

Don’t just work with MMs who invest. If they invest and also borrow your tokens, they may hedge against their own locked allocation—conflict of interest.

Work with 2–4 MMs across different exchanges. Easier to compare, more services, spreads risk. Don’t rely on just one.

If you’re self-market making on a DEX, estimate what your core users usually trade (around $1k each), then place liquidity within ±5–10% of the base price and keep the spread under 1%. That way you use capital more efficiently while still leaving a buffer.

Don’t stress too much about how users will buy your token. If they want it, they’ll find a way. Just make sure retail can jump in with a few hundred to a few thousand dollars, keep the spread within 1%, and if people see value in your project, they won’t mind paying that small premium.

— Wilson, Founder of XY Finance / SuperIntent (AW#20 & Portfolio)

Once you’ve nailed down the market making terms, the next big question is Listing—when to go live, which exchange to choose, and what route to take. Those decisions shape not just the first day’s price action but also the token’s long-term path in the market.

When to List?

Timing shapes first-day price action. Macro is unpredictable, so don’t waste time guessing peaks. Focus on what you control:

Project maturity: core features stable, audits done, tokenomics + release schedule published.

Competitor timing: avoid overlapping with hot projects. Launch just before/after them to capture attention.

Ecosystem liquidity: look at TVL trends, altcoin volume, ecosystem incentive programs. Launch into strength.

We picked November 2024 for our listing for a few reasons. Back in July, SUI’s price was climbing, altcoin volumes were up, and there weren’t many SUI projects launching tokens. November looked like the right window—good market conditions and, honestly, a bit of luck since we also guessed Trump might win. That timing worked.

— Typus Founder

After listing, performance really depends on whether the ecosystem’s players are willing to buy. ETH OGs usually just hold ETH and stake it on Lido or Pendle for yield—they won’t swap into other tokens. Solana’s different. Their OGs are happy to swap SOL into memecoins, which keeps altcoins moving. On Solana, memecoins are priced in SOL the way NFTs were priced in ETH last cycle. So if you want to ride a new ecosystem, you need to check if the OGs are willing to swap their layer-1 token and if the foundation will help with liquidity.

— Roise, Co-founder of PINGPONG (AW#30)

Where to List?

The final big call before listing is where to launch first. It really comes down to the founder’s TGE goal. If the goal is fundraising, the strategy should be low-cost and just cover core users with enough liquidity. If the goal is exposure, then the play is to maximize visibility and build a deep order book.

Depends on your goal: fundraise vs exposure

Closing

TGE isn’t the finish line—it’s the starting gun. The real race begins at T+1, when hype cools and buying demand fades. The question is whether the team can keep things moving, and that’s what will decide how far the token goes.

Next in the series: Post-TGE Operations

Managing sell pressure (staking, OTC, buy-backs).

Keeping liquidity alive (CEX / perp listings).

Growing the buyer base to include institutions and yield-focused investors.