TGE Playbook #4 - TGE is only the start. How to operate post‑TGE?

Welcome to the fourth article in the TGE Playbook series:

(T‑N months): Three big questions to ask yourself before TGE

(T‑6 months ~ T‑1 month): How do you build awareness leading up to your TGE?

(T‑1 month ~ TGE Day): How do you choose exchanges and market makers?

(Post‑TGE): TGE is only the start. How to operate post‑TGE? ← you’re here now

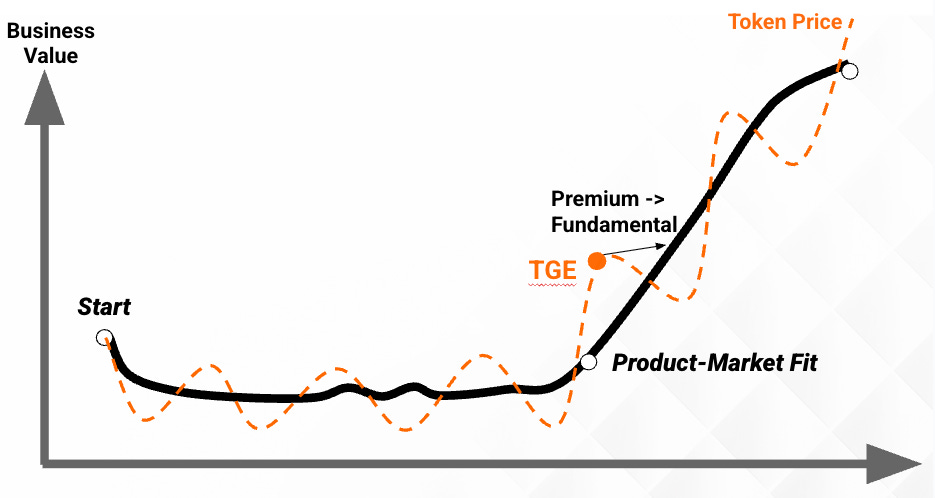

The TGE bell doesn’t mark the finish line, it’s the starting gun. The real challenge is figuring out how to use the token to turn short-lived hype into a lasting engine for product and business growth.

This article focuses on three key aspects of post-TGE operations: controlling sell pressure, sustaining liquidity, and ultimately binding token value tightly to product fundamentals.

Note: This guidance is especially relevant for awareness TGEs. For fundraise TGEs, most of the post-launch effort should go into product and market building. Only after achieving PMF does it make sense to revisit post-TGE management, since tokens from fundraise TGEs are usually in the hands of long-term believers who are less concerned with short-term volatility.

Sell Pressure Management: Turning Short-Term Dumping into Long-Term Conviction

The first thing after TGE: airdrops and early investor unlocks will inevitably bring initial sell pressure. Experienced teams put together tactics to transform short-term profit-taking into long-term conviction holding.

Staking & Locking Mechanisms: Design veTokenomics or staking plans that encourage users to lock tokens in exchange for governance rights, higher yields, or future benefits. The key is whether staking yields are backed by real revenue. Otherwise, it only inflates future sell pressure.

Continuously Finding the Next Narrative: Proactively create catalysts that the market looks forward to, reducing airdrop-driven sell pressure and shifting attention to new narratives.

OTC Deals: When early investors’ tokens are about to unlock, arrange OTC transfers to long-term institutional holders, minimizing direct market impact.

Strategic Buy-backs: Conduct token buybacks at critical times. This not only supports the price but also sends a strong signal: “we believe in our project.”

Ethena’s seamless narrative shift

Right after TGE, Ethena launched Season 2 of its “Sats Campaign,” shifting market focus from short-term TGE price performance to the bigger story of “introducing BTC collateral and pushing TVL to $5B.” This effectively managed community expectations and fueled the next growth phase.

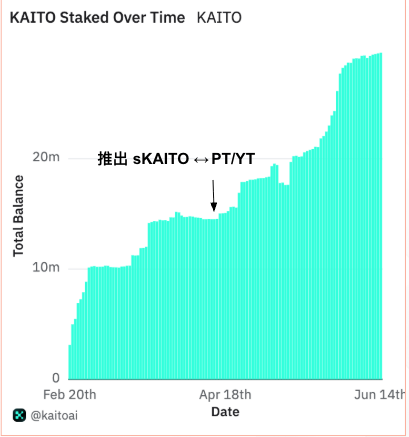

Kaito Founder publicly locks 1M tokens

The Kaito founder purchased 1M KAITO tokens (~$1.4M) and locked them publicly (with a transparent wallet address), making him the second-largest KAITO staker on-chain. These tokens will only unlock once Kaito revenue reaches $100M. This sent a strong signal to investors, reinforcing confidence.

Sustaining Liquidity – More Listings & Perpetual Contracts

One of the first tasks post-TGE is maintaining and expanding token liquidity. It’s not just for smooth trading — with more crypto VCs investing in liquid token, liquidity is now a critical metric for liquid fund.

In addition to listing spot markets on exchanges with better liquidity, perpetual contracts are another important channel.

Why perpetuals?

Perps attract higher-risk traders, increase market activity, and draw in market makers and arbitrageurs who stabilize prices via spot-futures arbitrage. This deepens liquidity. But, perpetual listings can bring risks — in illiquid markets, whales can manipulate prices with leverage.

How to get perpetual listings?

Each platform has different requirements:

dYdX: ~$80k average daily trading volume and at least 3 exchange listings

GMX: stricter, requiring ~$100M daily volume

Hyperliquid (HIP-3): anyone staking >1M HYPE can list a perp. If abused, tokens get slashed. Listing operators may emerge, potentially fundraising with HYPE LSDs, since listing fees share 50% with operators. With Hyperliquid’s $10B daily perp volume, it’s a channel worth watching.

Founders should also apply for oracles post-spot listing, since all perp markets require reliable price feeds. Choose favorable timing (e.g., positive news or bullish market) to apply for perp listings. If approved, coordinate announcements with exchanges, run campaigns or trading competitions, and bootstrap initial volume to build momentum.

Expanding to New Token Buyers

Once liquidity and sell pressure are stabilized, the next step is upgrading your audience from “airdrop farmers + retail” to buyers who can sustain price and bring strategic resources.

Two main paths: Liquid Fund & IR, Structured Products.

Institutional Capital: From Retail to Stable Buy-Side

Before TGE, retail investors dominate the spotlight, chasing airdrops, narratives, and quick pumps. That buzz is helpful early on, but once tokens list, they often cash out fast, putting strong sell pressure on the market.

After TGE, teams can start to look at institutional capital such as liquid funds—particularly in mid-cap tokens outside the top 10 and meme categories. With more crypto VCs active in secondary trading, these players become essential to stabilizing prices. They value data, business models over hype. Projects should be ready with dashboards and IR processes so institutions can engage, helping balance retail energy with longer-term capital.

Structured Products: Splitting a Token into PT + YT to Expand Buyers

If your staking yield comes from real revenue or profit-sharing, you can take that yield-bearing token and split it into PT (Principal Token) and YT (Yield Token). This way, the same token appeals to different investor groups:

YT: for yield chasers who want short-term upside, sometimes leveraging for higher APR.

PT: for conservative buyers, buying at a discount and redeeming full tokens later. With a liquid perp market, you can even attract delta-neutral investors. For example, someone can hold PT as the spot token while shorting the corresponding perp, effectively locking in yield without worrying about fluctuations in the underlying token price.

Kaito x Pendle case

Once sKaito had real yield, PT/ YT-sKaito was launched. Locked tokens grew 22% in one week, with over half from new users. Structured products clearly expanded the buyer base.

Using Price Premium & Liquidity to Drive Business Goals

When your token has price premium and deep liquidity, it becomes more than a trading tool — it’s a financial instrument for achieving business objectives and scaling from 10 to 100.

M&A: Use token + small cash to acquire complementary products or teams. This strengthens moat and brings in their community and TVL.

Boosting Ecosystem: Use token liquidity subsidies to attract projects into your ecosystem. Many L1s used their token premium this way.

Lowering CAC: High-premium, liquid tokens allow impactful user incentives with fewer tokens. E.g., trading competitions or launchpad campaigns at lower real cost.

Virtuals’ Launchpad flywheel

For each new launchpad project, $VIRTUAL raised + ~12.5% of partner tokens get locked into LP. Meanwhile, 1% of all $VIRTUAL raised is burned. Result: every new pool both increases demand and reduces supply. Virtuals uses its token to deepen liquidity for newcomers while creating long-term buy pressure for itself — a flywheel that boosts $VIRTUAL value and attracts more projects.

Conclusion

TGE is like the “bell ringing” of going public in crypto — once rung, there’s no redo. Returning to our framework (“Goal Setting → KPI Anchoring → Flywheel Design → Resource Allocation”), we’ve shown how to adjust strategies for fundraise vs awareness TGEs.

Two final reminders:

TGE is a one-shot game. Better to wait until both product and narrative have leverage before launching. If fundraise is needed, recognize it’s hard to regain attention after TGE. Build a strong Cap Table before TGE, and post-TGE, focus on product and community. Long-term believers will stick around.

Fundraise/awareness isn’t the end — it’s Day 1 of real operations. Success post-TGE requires constant product iteration and narrative updates to sustain token premium and liquidity, pushing business value upward.

“Honestly, post-TGE is a totally different game. I actually wish we had launched later, because after TGE it’s really hard to attract attention again.”

— Yu Hu, Founder of Kaito

This reflection is a reminder that the spotlight around a TGE fades fast. What truly sustains token price and brand over time are product milestones, strong data, and evolving narratives. TGE is only the beginning, and the real survivors will be the teams that keep delivering value and showing steady growth.

Special thanks to all friends and founders who contributed to this series: Fenix (AW#17 Teahouse), Edwin (AW#19 Portto), Paul (AW#26 XO), Rosie (AW#30 PINGPONG), Austin (AW#30 Yei Finance), Ali (AW#30 OMO), Wilson (AW#20 XY Finance), Justin (AW Portcos Zeus), Tommy (Typus), Yu Hu (Kaito), 與 Ev (Legion)

If you have any feedback, please contact AppWorks and the author, Bill Hsu.