TGE Playbook #2 - How do you build awareness leading up to your TGE?

Welcome to the second article in the TGE Playbook series:

(T‑N months): Three big questions to ask yourself before TGE

(T‑6 months ~ T‑1 month): How do you build awareness leading up to your TGE? ← you’re here now

(T‑1 month ~ TGE Day): How do you choose exchanges and market makers?

(Post‑TGE): TGE is only the start. How to operate post‑TGE?

Once you’ve clarified where the marketing budget should go and which Anchor KPI to focus on, every pre‑TGE step should help you reach that goal. Whether you’re hiring KOLs or designing a points program, always ask: Does this actually help hit my main goal? If not, you’re probably just burning time and money. Drop it and pick something that’s clearly moving you toward the target.

#1 — What’s the narrative?

The very first thing, and the most important, before any pre‑TGE plan is to identify the strongest narratives for the project.

Make the value proposition understandable in 30 seconds. With VCs, you can talk for hours and dive into the weeds. But in a TGE, you’re fighting for attention from retail and degens. They’re not going to read your whitepaper cover to cover or study your contracts. You need to hook them instantly, If they can understand it that fast, they can repeat it, share it, and suddenly your story’s everywhere.

Founders should tell the story themselves. When you speak directly, you’re not just passing along info—you’re showing your face, your conviction. Most people can’t check the tech under the hood anyway, so in the end they’re really asking, “Do I trust these people?”

Challenge old narratives to stand out. Poke at industry “truths” and you’ll often light up debates. If you’ve got the data or a strong story to back it, that spark can pull the conversation your way.

Ethena: Internet Bond

Framed itself with a super‑familiar concept: “bonds.” Think of it as a bond you can buy on the internet—high yield, low risk, and you can own it anytime, anywhere.

Huma Finance: Turning a PR mess into a pre‑TGE win

Early on, Huma hit a PR storm. Instead of hiding, founder Richard owned it—public apology, then back‑to‑back AMAs and debates with KOLs to answer hard questions about the business and risks. That moved the conversation from gossip back to the actual model. He even went after a core industry belief: that “high TVL means a good project.” For bridge loans, TVL’s not the point—speed of deposits selling out is. And he proved it: from 10 days to sell out, to 3 hours. That shift in narrative fired up discussion and ended with a Binance listing.

Here’s where fundraising‑driven and awareness‑driven TGEs split. It’s all about who you’re talking to:

Fundraise‑driven: You’re building a solid cap table. That means chasing power users—not just heavy users, but people willing to hold long term and lock their tokens. Think angel investors and battle‑tested DeFi pros. Your narrative here should highlight what makes you different and how big the opportunity is.

Awareness‑driven: You still want those power users, but you’re also pulling in airdrop hunters and narrative traders—people who live for hype cycles. They might bail after the buzz, but before TGE they can supercharge your reach, stir up FOMO, and flood timelines. Your story has to be quick, clear, and easy to share so they can spread it at speed.

Kaito:

“Proof of Attention” aimed at power users. Their users, including KOLs, can grasp the concept quickly.

“InfoFi” aimed at narrative traders. Those who experienced DeFi, GameFi, and SocialFi will see this as a potential next narrative hotspot.

Choosing your target audience determines whether you’re optimizing for token‑holder quality or reach at scale. That’s the starting point for TGE success.

#2 — Points program and airdrop

In a TGE “points program + airdrop,” points guide behaviors and airdrop sets reward expectations. The former tells the community what to do; the latter tells them that effort will be rewarded. To “keep the right people and filter out the wrong ones,” you must first define your ideal customer profile, design behaviors aligned with your goals, and build in anti‑sybil mechanisms. If not, bots will farm points at scale and dump after airdrop.

Differences between fundraise‑driven vs awareness‑driven airdrops:

ICP: Fundraise‑driven goes after power users who really feel the problem and are in it for the long haul. Your ICP here should be super clear, and you might even check on‑chain activity and how sticky they are with the product. Awareness‑driven takes a looser approach—widening the net to reach anyone who can spread the word fast. The goal is to spark sharing and fuel leaderboard battles so people compete for top spots, cranking up FOMO and keeping the community buzzing.

Airdrop: For fundraised‑driven plays, you usually keep it under 5% so holder quality stays high. Awareness‑driven can go bigger—5–10%+—to spark maximum buzz.

Sell‑pressure reduction: Fundraise‑driven leans on a tight ICP plus lockups. Awareness‑driven is all about booting point farmers and giving points more utility so they’re not just tied to the airdrop allocation. Think product perks, launchpad allocation, or other non‑linear rewards—keeps the energy high and avoids blowback from airdrop hunters.

Kaito Yap: Points as proof of influence, not just airdrop eligibility

The team kept pushing Proof of Attention so the the points (Yaps) are not just airdrop allocation. Sure, some folks complained when the airdrop dropped, but Yap quickly became a criteria for many other projects’ airdrops—suddenly that “influence badge” had real value. KOLs kept showing up in the points program even after the Kaito Token airdrop was over.

Binance Alpha Point: Points as lottery tickets:

By tying early TGE allocations and whitelist spots to points for high‑profile projects, Binance Alpha fueled plenty of “get‑rich” legends. The constant points‑grind doubled trading volume after launch, and by May 12, daily volume hit $5B—a whopping 95% of all wallet trades. So lottery‑style mechanics still hit hard in crypto. Plenty of people are chasing that overnight moonshot.

#3 — VIP Group

When the buzz from your points program, airdrop, or testnet starts cooling off, drop a new identity badge to keep your real power users hooked. A membership‑style NFT can hit two birds with one stone:

Lock in your core voices. Only folks willing to put in gas, cash, or time will mint—instantly filtering for the serious ones.

Create visible scarcity. On‑chain supply and floor price become your built‑in FOMO signal.

Fundraise‑driven vs awareness‑driven VIP moves:

Fundraise focus: Go with limited + paid NFTs, ideally linked to a small seed allocation so your power users feel like they’ve scored early‑investor perks.

Awareness focus: Keep them cheap or even free—make the NFT the thing that drives viral community growth.

“In our first year, we minted NFTs to kickstart the community. Without them, our visibility would’ve been way lower. I see NFTs as a simple membership pass—when deposits or trading volume go up, members level up automatically and share rebates. It boosted retention, kept people engaged, and only cost a few thousand dollars. Plus, it opened doors with the Sui Foundation and local communities. ROI is quite good.”

— Typus Founder

#4 — KOL Marketing

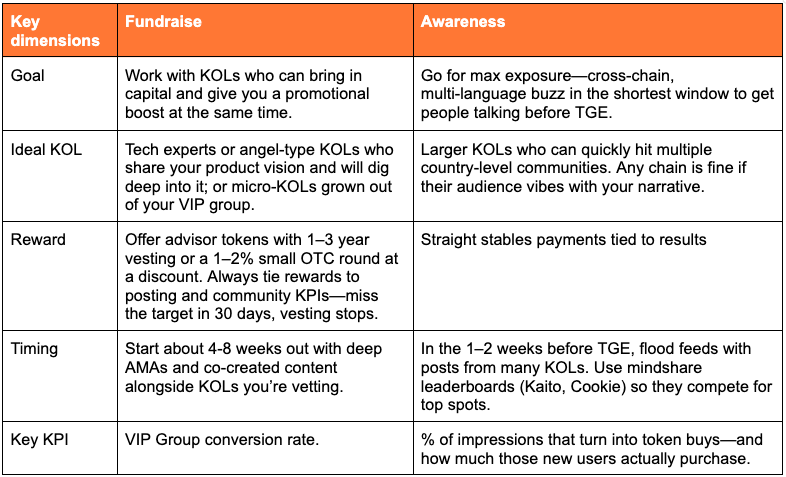

All your earlier moves are just piling up the kindling. KOLs are the spark that sets it ablaze, carrying your story across languages and communities. The playbook changes depending on whether your TGE is fundraise‑driven or awareness‑driven:

“Spend $1,000 to test a KOL list first. Track new waitlist signups and wallet addresses. We only go bigger if they hit our conversion target.”

— Wilson, Founder of XY Finance / SuperIntent (AW#20 & Portfolio)

“We skip agencies. We track KOLs down ourselves—even bring pineapple cakes to meet and seal the deal. We gave advisor tokens with contracts that stop vesting if there’s no Zeus‑related output in a month. We also built a 30‑person Zeus Alpha Group. Each member gets a fixed monthly token amount to support local events and how‑to content.”

— Justin, Co‑founder of Zeus (AW Portfolio)

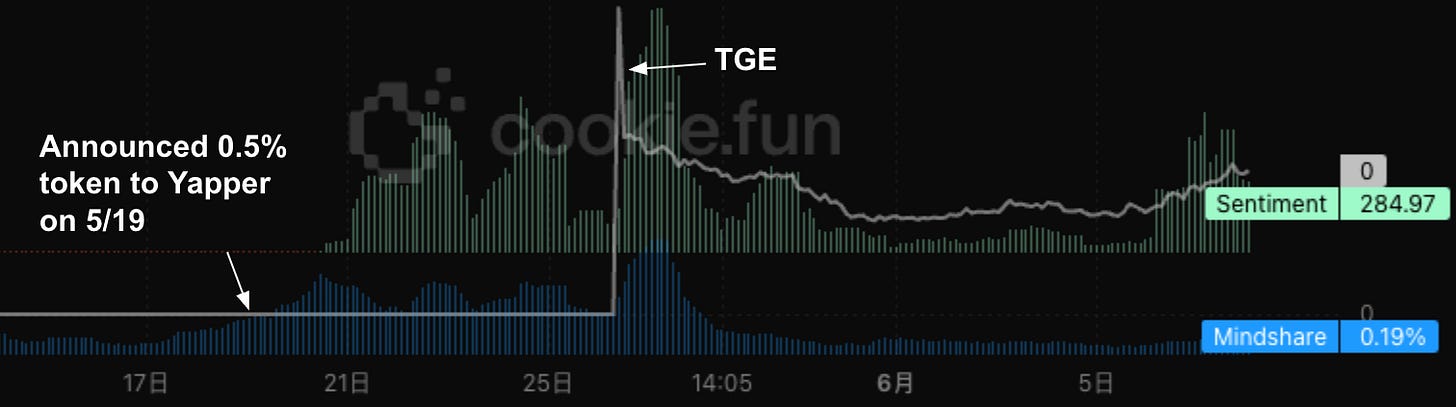

Huma Finance scaled KOL impact using mindshare platforms:

Huma airdropped 0.5% of its token supply to the Yapper community, peaking mindshare and landing a Binance listing at TGE. data source

Mixing both styles works well: turn VIPs into micro‑KOLs to lock in key network nodes, then bring in awareness‑driven KOLs to blanket ecosystems—tracking KPIs and testing along the way.

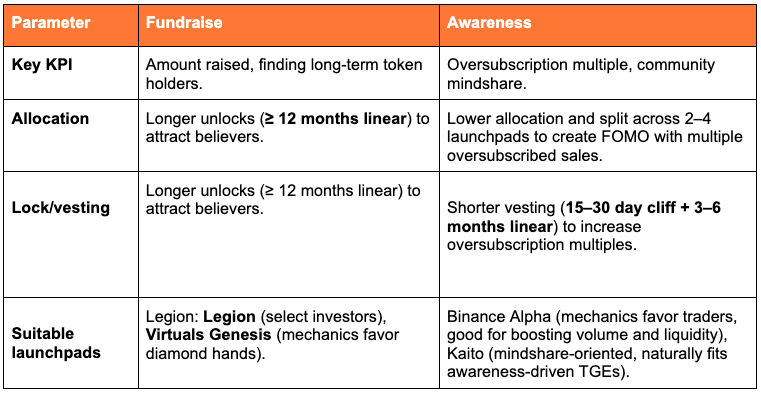

#5 — Launchpad

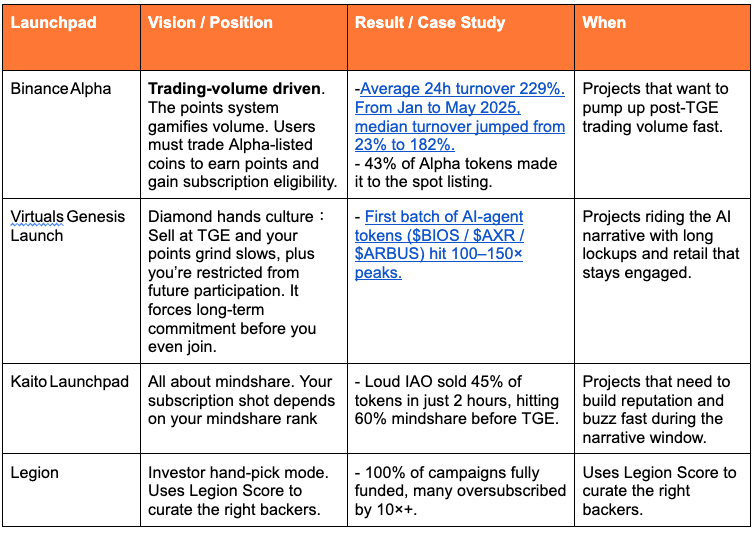

In the past year, a wave of new launchpads has popped up: Legion (curates investors for founders using Legion Score), Binance Alpha (powered by traffic from a top exchange), Virtuals Genesis (specializes in AI‑agent tokens), and Kaito Launchpad (whitelists based on mindshare rankings). They’re not just fundraising tools—they’re key pre‑TGE hype machines. Each comes with its own strengths and sweet spots:

Don’t forget: before choosing a launchpad or tactical details, always return to the first question — is your core objective fundraise or awareness?

We used Legion and received over 700 applications initially. With Legion Score, we selected the 100 most suitable investors: 50 technical experts to stress‑test the simulation engine, 40 growth partners to connect DeFi ecosystems, and 10 core contributors and advisors. It wasn’t just fundraising. It also laid the groundwork for future product testing and integrations.

— Michael, CEO of Almanak (AW Portfolio)

The Pre-flight Checklist

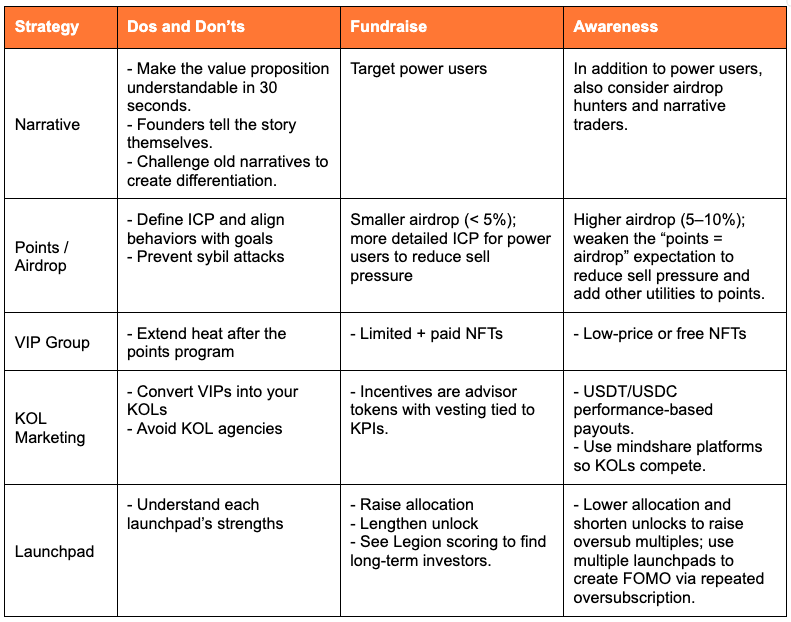

We’ve boiled those five levers — narrative, points/airdrop, VIP group, KOL marketing, and launchpad — into a quick‑hit checklist. It’s not a magic formula, but it’s an easy way to make sure every tactic matches your main KPI and doesn’t work against the others.

If you can check off every item here and keep it aligned with your core KPI, you’ve built the early‑stage flywheel: narrative → community → viral spread → conversion.

From there, it’s time to tackle two big pre‑TGE calls: which exchanges to list on and which market makers to work with.