Surf’s Up: Reflecting on Web3 and Macroeconomics Heading into 2024

🌊 Promising indicators suggest the tide has turned and now's the best time to get into web3

In the past two years, startups have faced significant challenges due to rising interest rates, drawing liquidity from early-stage funding. Concerns about a financial crisis loomed, highlighted by the unexpected collapse of Silicon Valley Bank.

For web3 founders, trials included the downturn of FTX and Luna. Yet, it's precisely during these challenges that resilient founders distinguish themselves and emerge as leaders in fulfilling their mission.

A small group of founders and builders is driving transformative changes in the web3 space. Notably, we are witnessing a consistent decline in on-chain transaction costs, propelled by the improvements and adoption of Layer 2 blockchains.

Additionally, with zero-knowledge solutions on the horizon promising enhanced privacy and real-world processing speeds, it’d finally allow blockchain applications to expand beyond niche “on-chain” projects like profile picture NFTs and web3-exclusive financial products.

These developments, together with account abstraction upgrades across the Ethereum Virtual Machine (EVM) ecosystems, bring us much closer to a user experience resembling today's software applications.

And now that the barrier to experiencing blockchain's strengths has been lowered, censorship resistance, true digital ownership, and trustless services will provide certain solutions with a 10x experience from the outset, serving as the main drivers for users to transition from web2 to web3.

The founders who can truly wield these web3 values will gain a winning edge against their competition by offering products with drastically different DNA.

However, if you have been hesitant about the prolonged downturn and have been holding off on entering this space, there's a glimmer of hope on the horizon, indicating the potential end of the bear cycle in web3.

I've summarized recent trends and the latest information on promising indicators as of October 24th, 2023, in both macro and web3.

These indicators suggest a positive shift within the next 12 to 18 months. So it's wise to dive in now and start paddling to capture this technological and behavioral paradigm shift, a cornerstone of many successful breakout startups we know today.

Shifting to the macroeconomy, in the United States, the Federal Reserve will look to maintain a 2% annual core Personal Consumption Expenditure (PCE) growth target, a key indicator of inflation. And the current policy communication suggests to achieve this by setting the central bank’s interest rate at 0.5% or 1% above the core PCE's annual growth rate.

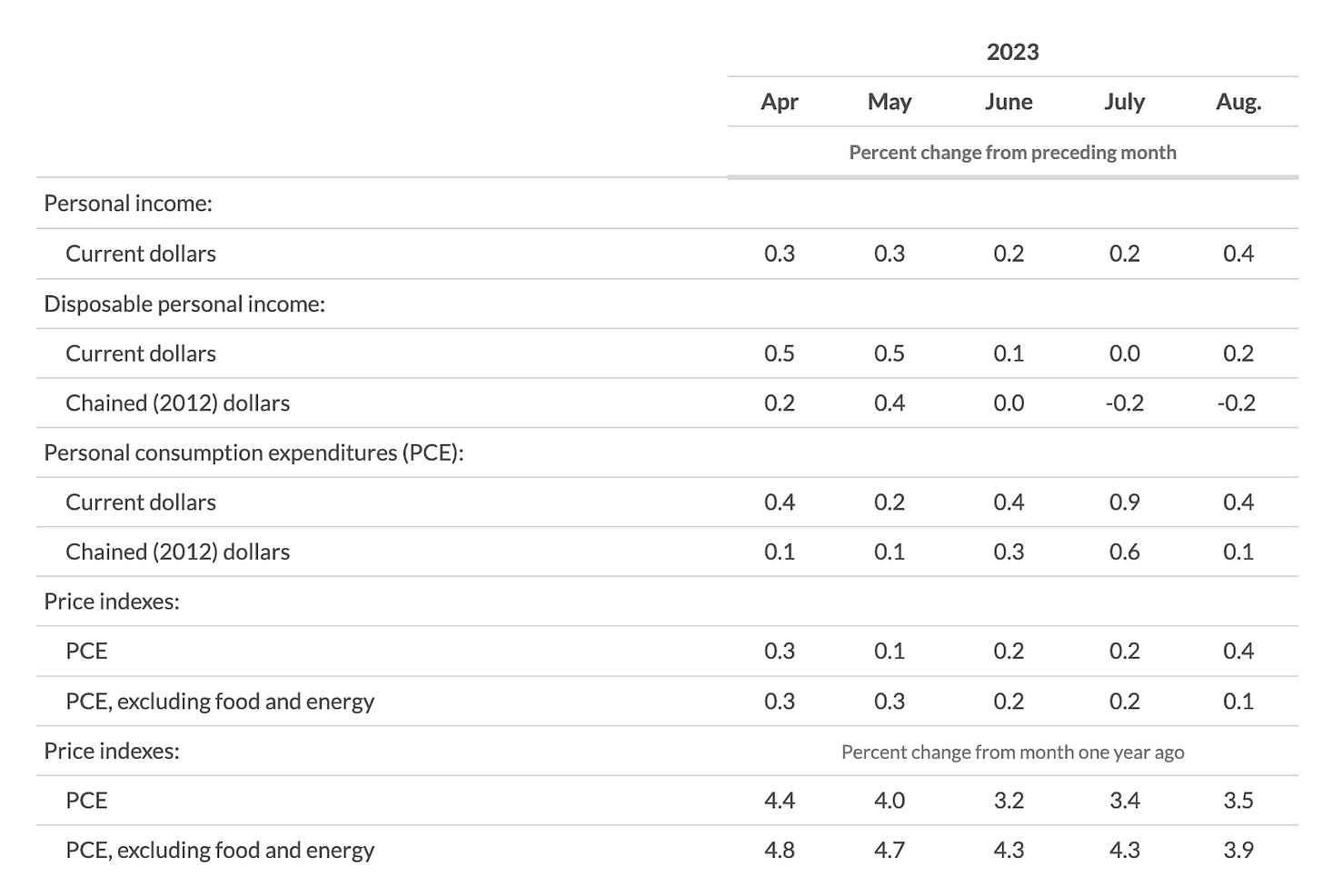

Examining the most recent trends released by the Bureau of Economics on September 29, 2023, the bottom two rows in the inflation chart below indicates a gradual reduction in PCE growth. This suggests that there is now room for the policy rate to follow suit, although it may still take two or three years to reach the 2% core PCE target.

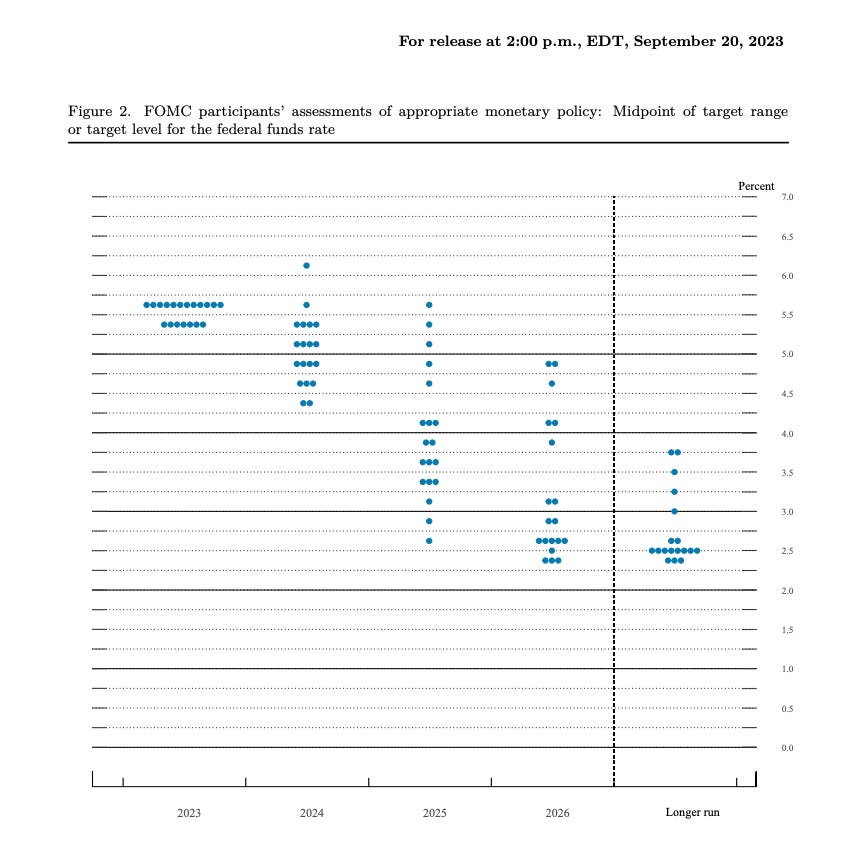

If we take a look at the Federal Reserve committee’s rate projection dot plot(page 4) released for September 20, 2023, it now closely aligns with the market’s expectations.

Indications point to only one more rate hike in 2023 as the peak, followed by a decline extending beyond 2026. Projections for the next three years strongly suggest rates will remain lower than in 2023, continuing to trend downward.

A high-interest rate market attracts liquidity to bonds and loans via traditional finance, while a lower-interest rate environment redirects liquidity back to places like crypto and web3, where participants can easily generate a 3% yield from staking Ethereum.

With traditional finance now looking at a decline in policy rate and yield, driven by the decrease in PCE and its growth, it’s a promising indicator suggesting a macroeconomic shift in favor of crypto as we near the end of 2023.

Now, let’s delve into the macro trends within web3.

Regulatory challenges have long hindered founders and users in the US and globally, but now that’s changing.

In Japan, Prime Minister Fumio Kishida is actively promoting policies to boost web3 technologies. This includes introducing a new crypto auditing process, regulating DAOs, reducing unrealized gains tax on crypto, and most importantly, allowing startups to raise funding via crypto instead of stock.

These changes signify strong support for the industry. Japan's rich gaming and intellectual property sectors, coupled with sophisticated users, high entertainment spending, and high population density, create an ideal environment for viral products.

Asia, known for its high entertainment spending and active investment, especially Japan, is poised to see more founders exploring the region's potential.

Meanwhile, across the globe, the London Stock Exchange Group (LSEG) is set to revolutionize traditional asset trading by adopting blockchain technology.

LSEG's goal is to streamline trading, boost transparency, and ensure regulatory compliance while harnessing the efficiency of blockchain. They aim to establish a global blockchain-powered ecosystem covering issuance, trading, and settlement and are actively seeking regulatory approval.

Leading economies, including England and Japan, are actively competing with the United States through regulatory arbitrage to attract more web3 founders. France, the United Arab Emirates (UAE), Singapore, and Hong Kong are also swiftly seizing this opportunity.

For web3 founders, there really is no better time than now. Governments worldwide are eager to collaborate, subsidize, and incentivize web3 startups so they can stay at the forefront of this paradigm shift. Leading to a global race among nations to provide regulatory clarity to an industry clouded in uncertainty for years.

The collective regulatory arbitrage has reached the ears and hearts of US policymakers, resulting in a shift in the regulatory stance in the most important market for web3 innovation and users.

A paramount recent development showcasing this progress is the successful appeal by Grayscale Bitcoin Trust (GBTC), a trust managing US$16 billion exclusively invested in Bitcoin, against the Securities and Exchange Commission (SEC).

For those unfamiliar, the SEC has repeatedly delayed the establishment of a clear regulatory framework to differentiate cryptocurrency characteristics as securities or cryptocurrencies.

In the case of GBTC, the SEC approved futures Bitcoin ETFs but rejected spot Bitcoin ETFs, citing concerns about price manipulation and fraud, even though both types use the same price feed and share surveillance agreements with the Chicago Mercantile Exchange for fraud prevention.

GBTC's appeal highlights the SEC's inconsistency, signaling to policymakers that the SEC's actions have been arbitrary and incoherent. Their failure to collaborate with legitimate entities like Coinbase and Grayscale in drafting an appropriate framework has hindered innovation rather than fostering it.

However, we are starting to see this change. As of October 13, the SEC forgo their defense against GBTC’s appeal. Raising expectations that the tides have now shifted due to pressure from Congress and that a possible approval for the spot BTC ETF might happen before its submission deadline on January 17, 2024.

In the SEC's case against Ripple, the issuer of the XRP token, the SEC lost the ruling that the sale of XRP tokens on crypto exchanges doesn't violate securities law. Furthermore, the SEC lost its right to appeal the case. And on October 19, the SEC dismissed all charges against Ripple executives.

This shift in regulatory stance from the SEC is a significant win for the global crypto industry. With the most influential market now likely to legitimize crypto, we can expect increased support from politicians and lawmakers all around the world, particularly in the event of a Republican victory in the next US presidential election.

Either way, an approved spot Bitcoin ETF would trigger an avalanche of institutional investors flooding into the crypto space, such as BlackRock and Ark’s spot Bitcoin and spot Ethereum ETFs, respectively.

We already got a small taste of the anticipation that is building when Cointelegraph published a false report of BlackRock’s spot BTC ETF being approved on October, 17, 2023, sending Bitcoin up almost 10% to US$30,000 instantly.

And on October 24, 2023, Decrypt’s reporting that Blackrock has lined up seed investors for their Spot ETF and has prepared their trading ticker “IBTC” also sent Bitcoin up another 20%, hitting US$35,000.

Why is a spot ETF such a big deal for Bitcoin? Similar to regular ETFs, the investment in the fund is used to buy a basket of actual stocks to make up for the fund's value. Similarly, a spot Bitcoin ETF will transition institutional demand into Bitcoin holdings without institutions needing to use crypto wallets or worry about the safekeeping of their crypto currencies.

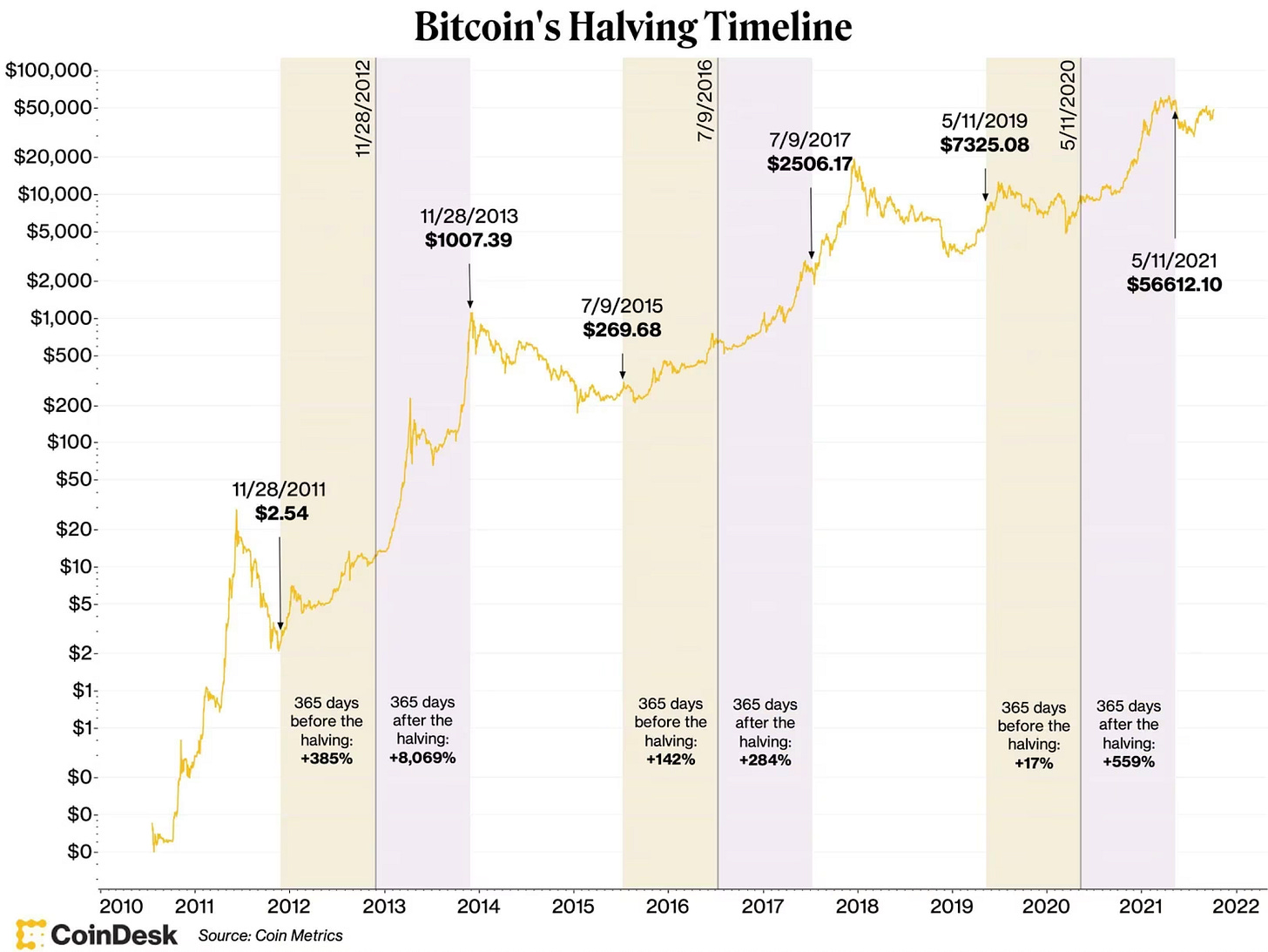

If you remain unconvinced at this point, there's another highly anticipated web3 event in 2024 that you can take advantage of: the next Bitcoin mining rewards halving.

In Bitcoin's original design, miners are rewarded for processing network transactions using computational power. This reward system halves roughly every four years to mitigate Bitcoin's inflation.

By April 16, 2024, the block height will hit the next halving milestone, reducing the new supply of Bitcoin. Based on historical data, this reduction, along with the same demand as of today, is expected to drive a considerable increase in the price.

And in the event that the Bitcoin spot ETFs were to be approved around the same period as the halving, there would be an unprecedented inflow of investment into Bitcoin that could add hundreds of billions of dollars to the market cap by the end of 2024.

But let's shift the focus away from Bitcoin's price speculation. The key here is the potential outflow of profits resulting from Bitcoin's halving as it seeks utility in other ecosystems. This drives demand for financial services like lending and yield generation, as well as for NFTs, gaming assets, digital goods, and more.

This is why founders should seize the opportunity to enter web3 now. With these positive macro shifts underway, those with unwavering commitment to their mission, agile learning, and execution skills will reap the rewards of renewed user demand and increased capital inflow.

So, if you haven’t started building in web3 already, there are plenty of problems yet to be solved. And hopefully, I’ve convinced you that now is the perfect time to get started so you can catch the upcoming tidal wave.

For those who have been building and tumbled through the previous ups and downs, you survived. Congratulations! You must have learned a lot of valuable lessons along the way; make sure you don’t forget them as the market improves. Though we are not completely out of the woods yet, there is indeed light at the end of the tunnel.

If you are a founder or thinking about becoming one, don’t build or surf alone. There are endless lessons, mistakes, tactics, and strategies to share among founders that can make your journey smoother.

My final alpha for you is to join the AppWorks Accelerator and become a part of Asia's largest founder community. The application for the 28th batch is currently underway.

The AppWorks ecosystem is a collective of founders who are committed to helping each other succeed. And over the last 13 years, we’ve grown to a strong network of 1,500+ founders and 490 startups, with US$15 billion in gross revenue every year.

We are extremely excited about building meaningful products and supporting outstanding founders in the web3 space. So if you are interested in finding out more, you can check out our social channels (Twitter & Facebook) and our website for more information.

By,

Jack An, Associate at AppWorks